5 Year Arm Mortgage Definition

The 5 in the loan s name means it s fixed for five.

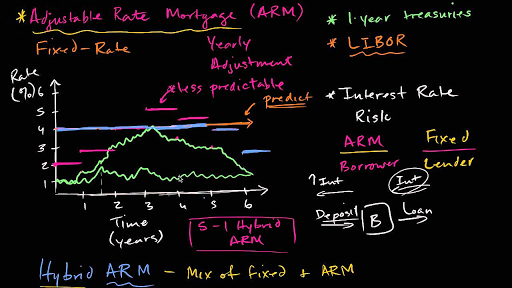

5 year arm mortgage definition. After that the mortgage rate becomes variable and adjusts every five years. After that the mortgage rate becomes variable and adjusts every five years. A 5 1 adjustable rate mortgage or arm is a mortgage loan that has a fixed rate for the first five years and then switches to an adjustable rate mortgage for the remainder of its term. Hybrid arms are very popular with consumers as.

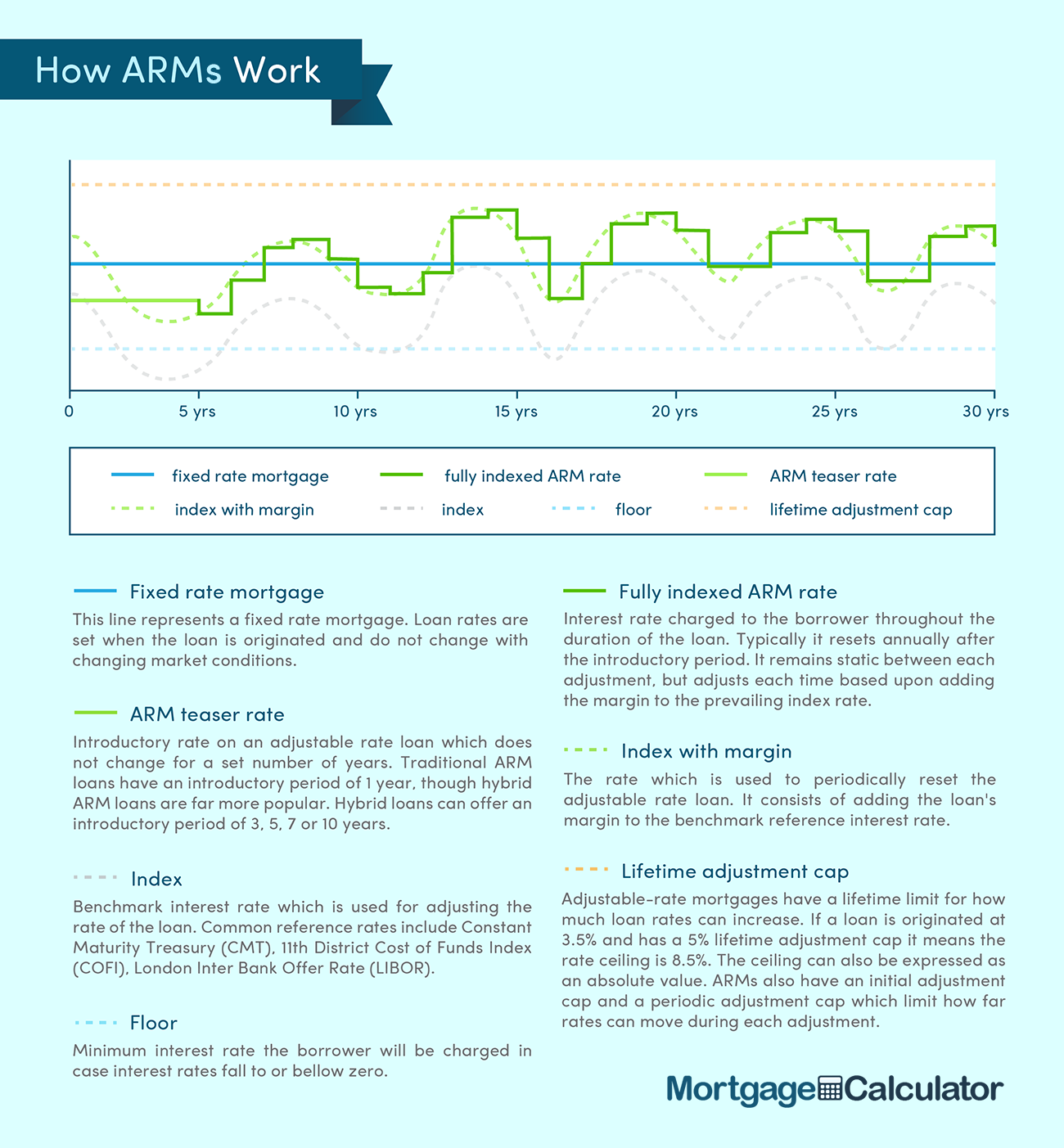

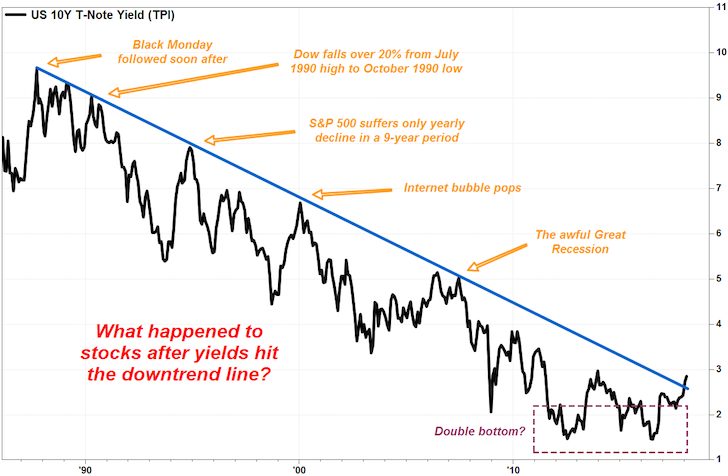

Also known as a five year fixed period arm or 5 year arm this mortgage features an interest rate that adjusts according to an index plus a margin. A variable rate mortgage adjustable rate mortgage arm or tracker mortgage is a mortgage loan with the interest rate on the note periodically adjusted based on an index which reflects the cost to the lender of borrowing on the credit markets. 5 1 arm rates are a bargain but not without risk rates for an adjustable rate mortgage arm are almost always lower than those for a fixed rate mortgage frm. For instance a 5 1 arm has a fixed rate for five years and then its rate would reset once a year for the remaining 25 years of its term.

A 5 5 arm is an adjustable rate mortgage that has a fixed mortgage rate for the first five years of a 30 year loan term. A 5 5 arm mortgage is a loan option for potential home buyers in which interest rates change or are adjustable after a period of time. The 5 1 hybrid arm an adjustable rate mortgage with an initial five year fixed interest rate after which the interest rate adjusts every 12 months according to an index plus a margin. The loan may be offered at the lender s standard variable rate base rate.

A 5 1 arm mortgage is a hybrid mortgage that combines fixed and adjustable mortgages into one loan. Your interest rate is set for 3 years then adjusts for 27 years. In this case the interest rate won t change during the first five years of the mortgage. General advantages and disadvantages.

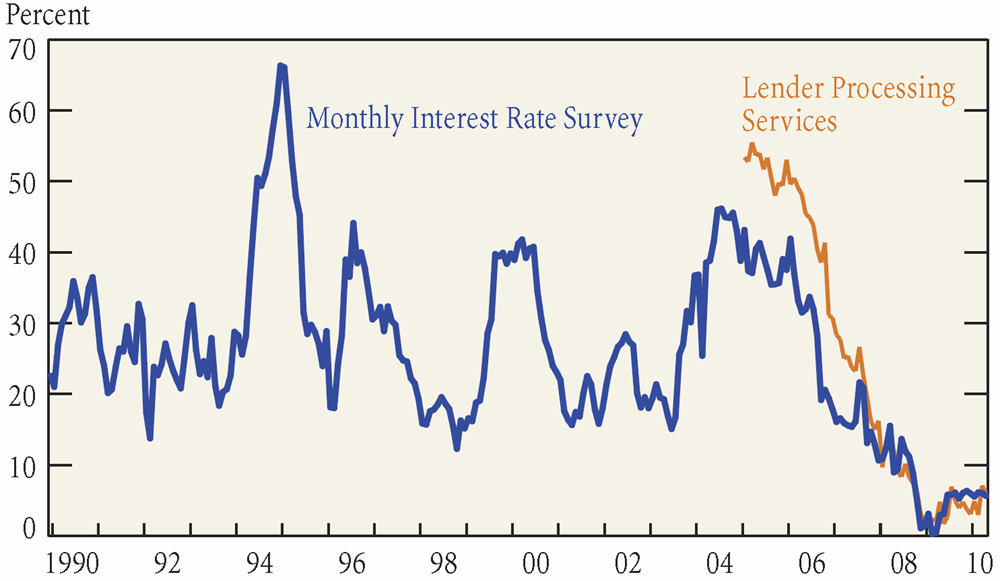

Since 2005 5 1 arm rates have been.