529 Room And Board Limits

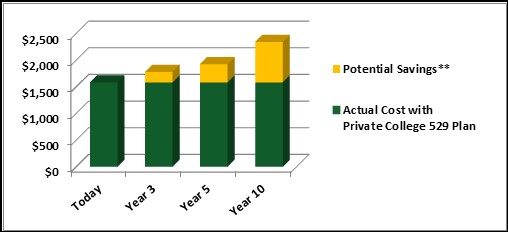

Parents can save for future room and board costs with a tax advantaged 529 plan.

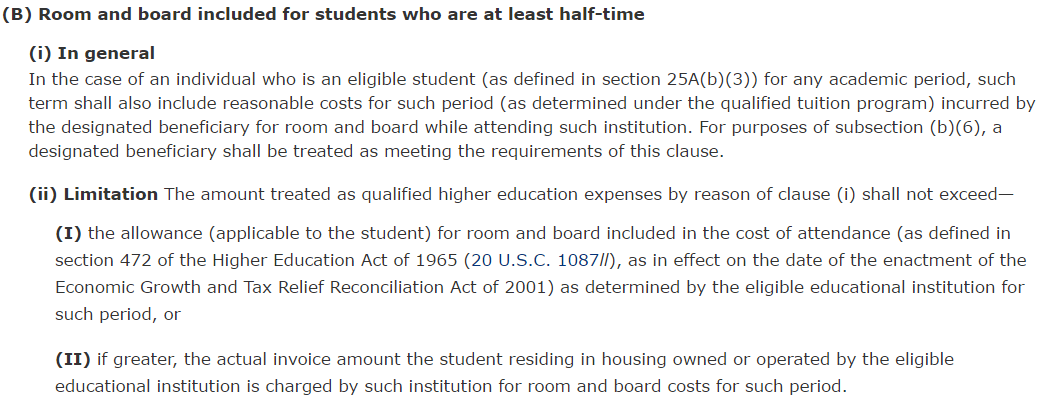

529 room and board limits. The student must be enrolled as a regular student on at least a half time basis. The generally accepted guideline is that this limit. If a 529 plan distribution is used to pay for room and board it is a tax free qualified distribution in certain circumstances and a taxable non qualified distribution in other circumstances. The allowance for room and board as determined by the eligible educational institution that was included in the cost of attendance for federal financial aid purposes for a particular academic period and living arrangement of the student.

There is also a 10 000 lifetime limit that applies to the 529 plan beneficiary and each of their siblings. To qualify as a 529 plan under federal rules plan balances cannot exceed the expected cost of a beneficiary s qualified education expenses. One of the tcja changes allows distributions from 529 plans to be used to pay up to a total of 10 000 of tuition per beneficiary regardless of the number of contributing plans each year at an elementary or secondary k 12. It s important to note if you pay a student loan with 529 plan money student loan interest paid for with tax free 529 plan earnings is not eligible for the student loan interest deduction.

The caveat here is that your off campus housing costs can t be higher than you d pay to live on campus if you want to use 529 funds. But if you are using your 529 plan for room and board expenses it s smart to keep those receipts. The expense for room and board qualifies only to the extent that it is not more than the greater of the following two amounts. Room and board whether you live on campus or off you can use your 529 plan spending for your room and board expenses.

If costs continue to rise at an annual rate of 3 total room and board at public 4 year colleges and private 4 year colleges may cost 71 000 and 85 000 respectively. The expense for room and board qualifies only to the extent that it is not more than the greater of the following two amounts. Qualified 529 plan expenses. The allowance for room and board as determined by the eligible educational institution that was included in the cost of attendance for federal financial aid purposes for a particular academic period and living arrangement of the student.

/GettyImages-936317872-35f1a1c79a9a4545ad7f71f05707338b.jpg)

.jpg)