529 Room And Board Irs

That post deals with supplies and equipment.

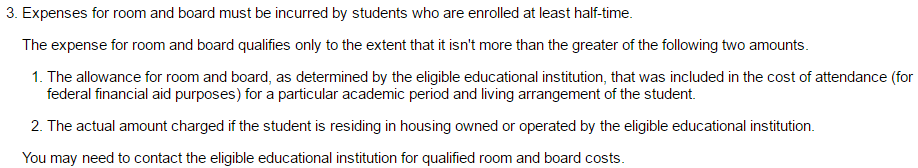

529 room and board irs. Room and board insurance medical expenses including student health fees transportation similar personal living or family expenses sports games hobbies or non credit course expenses for sports games hobbies or non. Room and board costs may be treated as qualified education expenses for 529 plan distribution purposes if the student is enrolled at least half time by the standards of the school. Significantly when an adjustment to qhee results in taxable income on 529 distributions the 10 percent penalty is waived. Room and board whether you live on campus or off you can use your 529 plan spending for your room and board expenses.

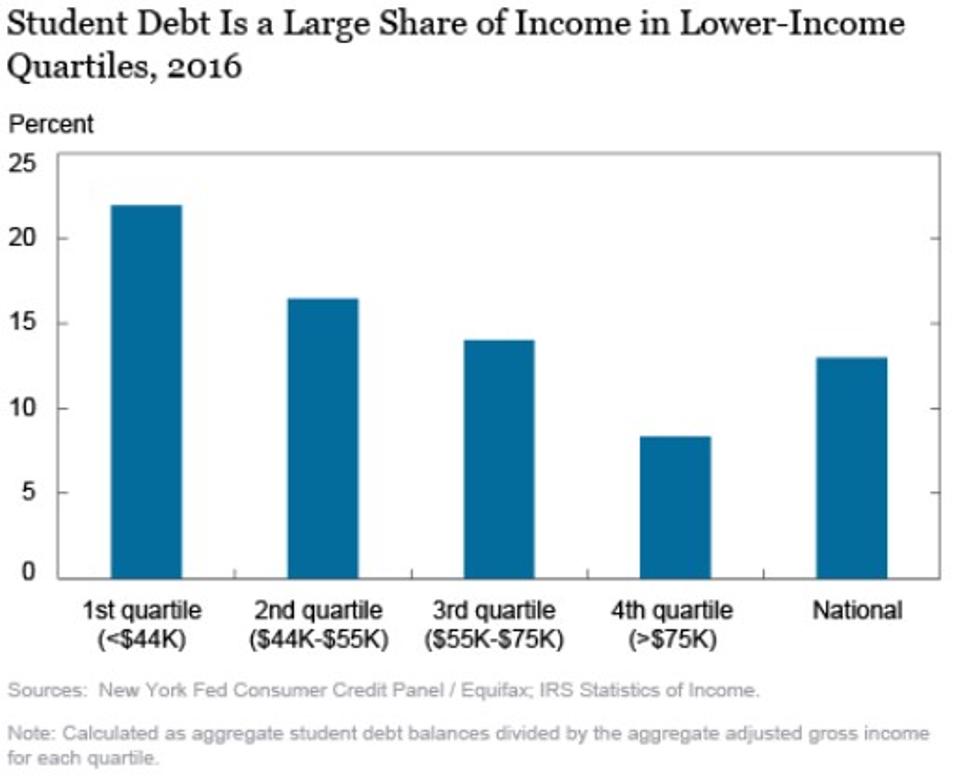

Using your 529 plan to pay for room and board room and board costs make up a large portion of a student s total college bill second only to tuition. A student does not have live on campus or in college approved housing for room and board to qualify as an education expense. But if you used 529 plan withdrawals to pay for tuition or room. If the student is living off campus you ll need to ask the school for its cost of.

This can occur when a student drops a class mid semester. My daughter lives in an on campus apartment. While funds from a 529 account can be used to pay for expenses required for college not all expenses qualify. Room and board includes the cost of housing and the cost of a meal plan.

In this post i m going to ask for opinions on room board. As i mentioned in another post i made i m doing some 529 planning. The coronavirus caused 529 plan tax risk you can t ignore with the coronavirus canceling college classes you could be due a refund. Now per the irs rules money from a 529 qtp plan can be used to pay for the qualified education expenses of tuition books and lab fees and for room and board provided of course that room and board is necessary for the.

The path act change added a special rule for a beneficiary of a 529 plan usually a student who receives a refund of tuition or other qualified education expenses. Tuition and fees are considered required expenses and are allowed but when it comes to room and board the costs.

:max_bytes(150000):strip_icc()/older-student-Matelly-56a449815f9b58b7d0d62b77.jpg)