5 Year Cds Spread Definition

:max_bytes(150000):strip_icc()/CorporateBonds_CreditRisk22-8c12f1dbc1494f28b3629d456fb4fa63.png)

These bonds usually offer a higher yield than government.

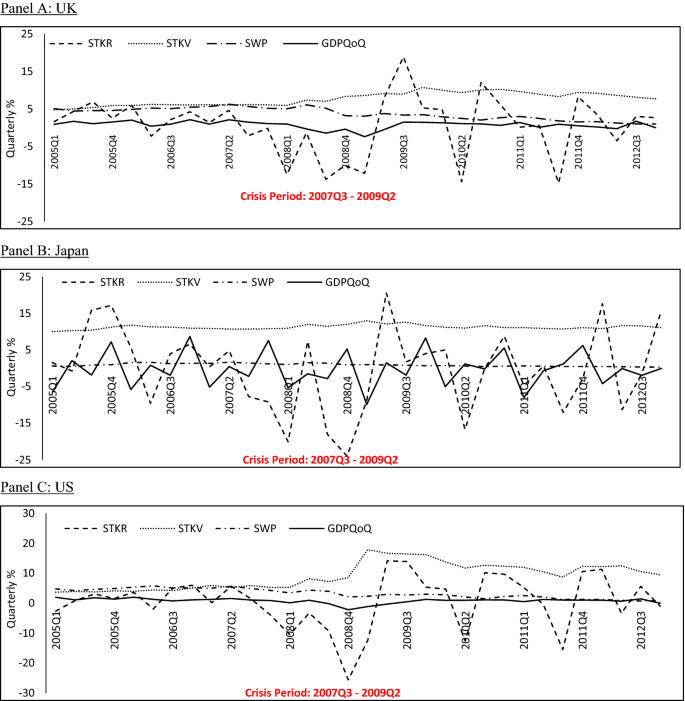

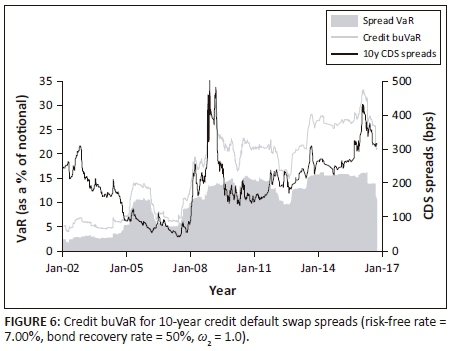

5 year cds spread definition. Cds value changed 2 48 during last week 13 74 during last month 5 37 during last year. This value reveals a 0 26 implied probability of default on a 40 recovery rate supposed. The buyer of the cds makes a series of payments the cds fee or spread to the seller and in exchange may expect to. A credit default swap spread is a measure of the cost of eliminating credit risk for a particular company using a credit default swap.

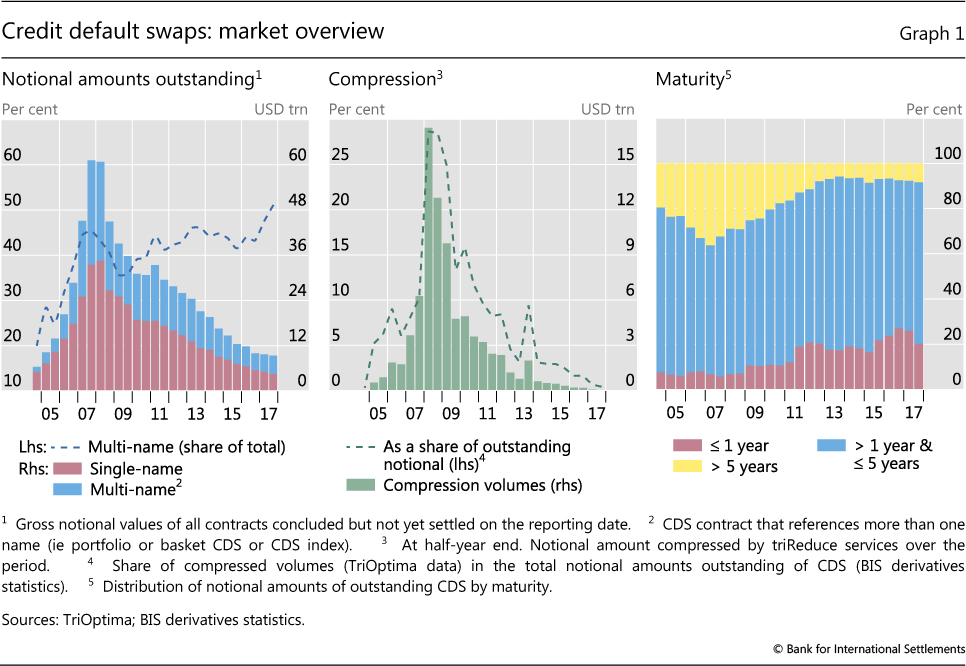

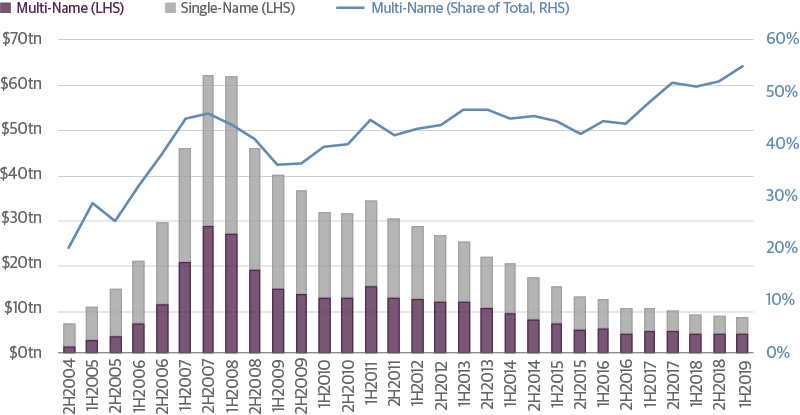

This page provides vietnam credit default swap historical data vietnam cds spread chart vietnam cds spread investing and data. The united states 5 years cds value is 15 7 last update. The basis is the difference between the spread over the risk free rate on a bond issued by a government and corporate and the cds spread. A credit default swap cds insures against losses stemming from a credit event.

A credit default swap cds is a financial swap agreement that the seller of the cds will compensate the buyer in the event of a debt default by the debtor or other credit event. When cds spreads widen it is a bearish signal and the stock prices of the firm typically. That is the seller of the cds insures the buyer against some reference asset defaulting. In other words the spread is the difference in returns due to different credit qualities.

5 oct 2020 17 45 gmt 0. For example if a 5 year treasury note is trading at a yield of 3 and a 5 year corporate bond corporate bonds corporate bonds are issued by corporations and usually mature within 1 to 30 years. Between cds spreads and the information they reflect about reference entities has become weaker during the recent years in which cds activity has declined. The five common variables that affect cds spread include the equity market s implied volatility industry leverage of the reference entity the risk free rate and liquidity of the cds contract.

The changes in cds spreads also affect the stock prices. Vietnam 5 year cds spreads are an indicator of the market current perception of vietnam default risk. A higher credit default swap spread indicates the market believes the company has a higher probability of being unable to pay investors which means it would default on its bonds. As a simple example greek 5 year bonds yield 440 bps over similar maturity german government bonds risk free hopefully and the cds is at 400 bps.

Current cds value reached its 6 months minimum value.

/idata%2F3271534%2Fcds1.png)

:max_bytes(150000):strip_icc()/dotdash_Final_Line_of_Credit_LOC_May_2020-01-b6dd7853664d4c03bde6b16adc22f806.jpg)

:max_bytes(150000):strip_icc()/dotdash_Final_Introduction_To_Counterparty_Risk_Feb_2020-02-5477c45c30ee48b4b09617f3b88300f4.jpg)

/CurrencySwapBasics-effa071aba184066b9683bf80750c254.png)