5 Year Arm Mortgage Rates History

Check the latest values of many of these indexes.

5 year arm mortgage rates history. This page lists historic values of major arm indexes used by mortgage lenders and servicers. Credit history the higher. Four years later in 2010 the annual 5 1 adjustable rate mortgage rate was 3 82 on average. 5 year adjustable rate mortgages arms since 2005.

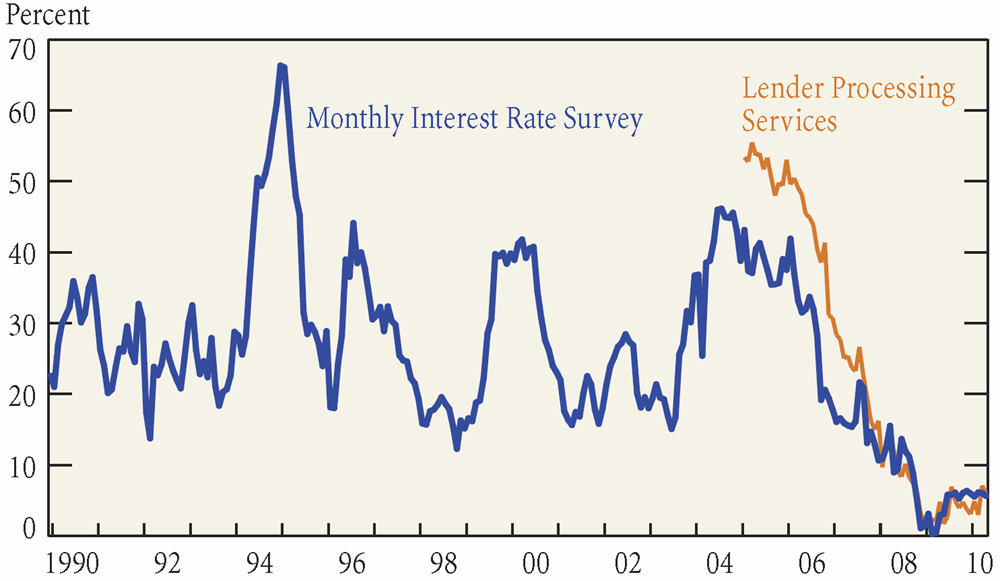

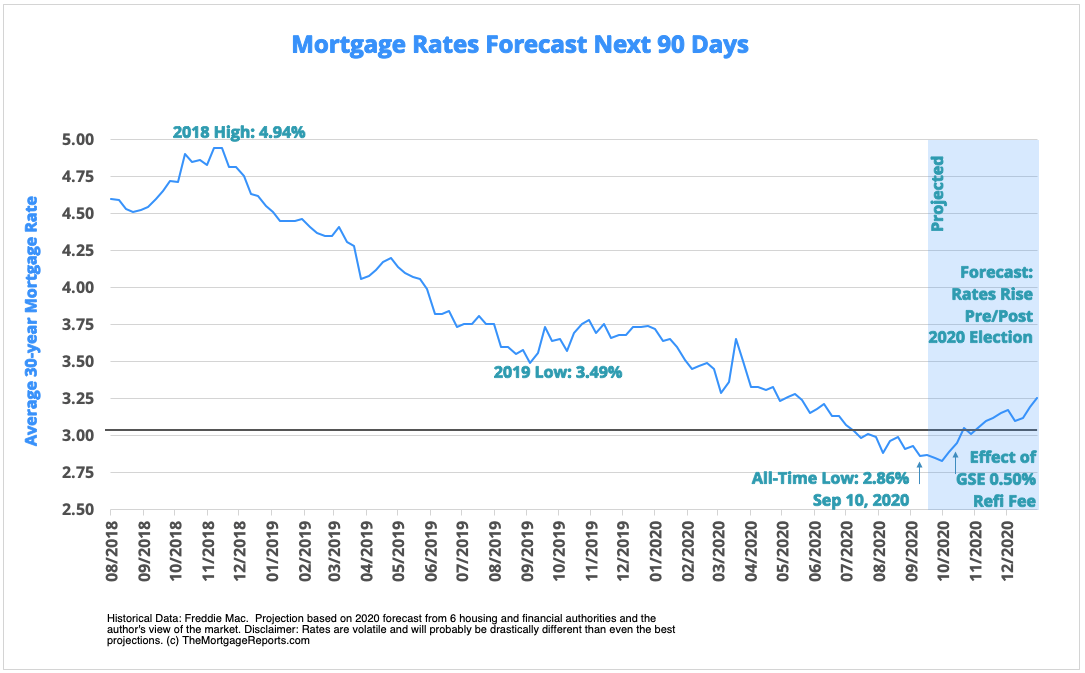

Arms generally have lower introductory rates compared with 30 year fixed rate mortgages. If you have an adjustable rate mortgage your arm is tied to an index which governs changes in your loan s interest rate and thus your payments. 5 1 arm mortgage rates have fallen since the mid 2000s. 5 1 adjustable rate mortgage rate is at 2 90 compared to 2 96 last week and 3 49 last year.

Annual mortgage rates for 5 1 arms have rested above 3 since 2017. This is lower than the long term average of 3 97. Historical rates data month year. 5 1 arm the first 5 years have a fixed rate followed by a floating rate.

Historical 5 1 arm rates. It s fast free and anonymous. Get customized quotes for your 5 1 adjustable rate mortgage. Monthly data by year data available from 1986 to 2016 weekly data by year data available from 1986 to 2016 mortgage rates by product.

Interest rates for arms are 0 37 percentage points lower than fixed rate mortgages through 2019. In 2006 the average annual 5 1 arm rate was 6 08. The 5 refers to the number. Compare mortgage rates from multiple lenders in one place.

Compare today s 5 1 arm rates from dozens of lenders. The 5 1 adjustable rate mortgage arm rate is the interest rate that us home buyers would pay if they were to take out a loan with a 5 year fixed rate followed by an adjustable rate for the balance. If you compare mortgage rates since 2005 5 year arm rates have trended lower than 30 year fixed rates.